When financial emergencies strike, traditional loans with extensive paperwork can feel overwhelming and time-consuming. A loan without paperwork offers a streamlined solution for those who need quick access to funds without the typical documentation burden. These instant payday loans provide fast approval processes, minimal requirements, and quick funding to help you address urgent financial needs. Understanding how these simplified lending options work can help you make informed decisions during financial stress.

What Is a Loan Without Paperwork?

A loan without paperwork refers to lending products that require minimal documentation compared to traditional bank loans. These loans typically eliminate the need for extensive financial records, tax returns, or lengthy application processes.

Instead of requiring stacks of documents, these loans focus on basic verification methods such as:

- Bank account verification

- Employment confirmation through pay stubs or direct deposit

- Identity verification with government-issued ID

- Income verification through bank statements

Key Benefits of Paperless Loans

Speed and Convenience The primary advantage of a loan without paperwork is the rapid application and approval process. Most lenders can process applications within minutes rather than days or weeks.

Accessibility These loans serve individuals who may not have access to traditional banking relationships or extensive financial documentation.

Emergency Relief When unexpected expenses arise, paperless loans provide immediate financial relief without bureaucratic delays.

Types of Loans Available Without Extensive Paperwork

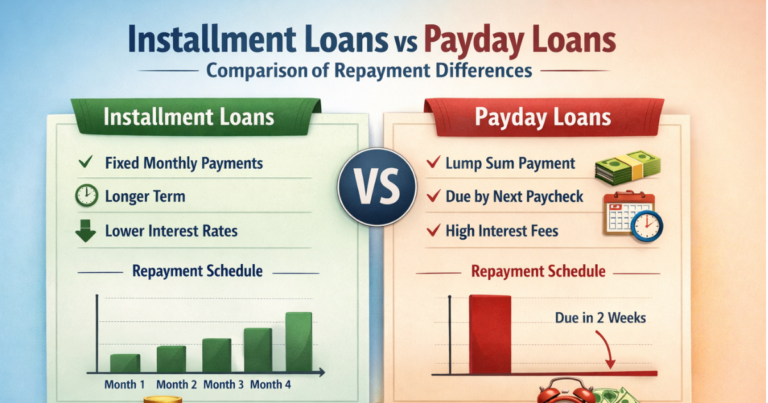

Payday Loans

Payday loans represent the most common type of loan without paperwork. These short-term loans typically require only basic information:

- Proof of income

- Active checking account

- Valid identification

- Contact information

Ready to get the funds you need? Apply Now at nexusloanhub.com for fast, hassle-free approval.

Cash Advances

Cash advances from credit cards or specialized lenders offer another paperless option. These advances provide immediate access to funds with minimal verification requirements.

Online Installment Loans

Some online lenders offer installment loans with reduced paperwork requirements. These loans provide:

- Longer repayment terms than payday loans

- Fixed monthly payments

- Streamlined application processes

How to Qualify for a Loan Without Paperwork

Basic Eligibility Requirements

Most paperless loan providers require applicants to meet these fundamental criteria:

- Age: Must be 18 years or older

- Income: Demonstrate regular income source

- Bank Account: Active checking or savings account

- Residency: Valid U.S. address and citizenship or permanent residency

Income Verification Methods

Lenders use alternative verification methods to confirm your ability to repay:

Bank Statement Analysis Lenders review your bank account activity to verify income patterns and financial stability.

Employment Verification Some lenders contact employers directly or use automated verification systems to confirm employment status.

Pay Stub Uploads Recent pay stubs provide immediate proof of income without extensive documentation.

The Application Process Explained

Step 1: Choose a Reputable Lender

Research lenders carefully and select those with:

- Transparent fee structures

- Clear terms and conditions

- Positive customer reviews

- Proper licensing in your state

Step 2: Complete the Online Application

Most paperless loan applications can be completed in under 10 minutes. You’ll typically provide:

- Personal information

- Employment details

- Banking information

- Loan amount requested

Need funds today? Start your application at nexusloanhub.com and get approved in minutes.

Step 3: Review and Accept Terms

Carefully review all loan terms including:

- Interest rates and APR

- Repayment schedule

- Fees and penalties

- Total cost of borrowing

Step 4: Receive Funds

Upon approval, funds are typically deposited directly into your bank account within 24 hours, often much faster.

Important Considerations and Warnings

Understanding the Costs

While loans without paperwork offer convenience, they often come with higher interest rates than traditional loans. Always calculate the total cost of borrowing before accepting any loan terms.

Repayment Obligations

Failure to repay loans on time can result in:

- Additional fees and penalties

- Negative impact on credit scores

- Collection activities

- Extended debt cycles

State Regulations

Payday loan regulations vary significantly by state. Some states prohibit high-cost short-term lending entirely, while others have specific consumer protections in place.

Alternatives to Consider

Before pursuing a loan without paperwork, consider these alternatives:

- Credit union loans: Often offer better terms with reasonable documentation requirements

- Personal loans from banks: May have more favorable interest rates

- Credit card cash advances: Could be less expensive than payday loans

- Employer advances: Some employers offer payroll advances

- Family or friend loans: Personal arrangements without interest

Explore all your options and compare rates at nexusloanhub.com to find the best solution for your needs.

Protecting Yourself as a Borrower

Red Flags to Avoid

Be cautious of lenders who:

- Guarantee approval regardless of credit history

- Request upfront fees

- Lack proper state licensing

- Have no physical address or phone number

- Use high-pressure sales tactics

Best Practices

- Borrow only what you can afford to repay

- Read all terms and conditions carefully

- Keep records of all loan documents

- Set up automatic payments to avoid late fees

- Contact the lender immediately if you experience repayment difficulties

Frequently Asked Questions

Q: How quickly can I get approved for a loan without paperwork? A: Most online lenders provide approval decisions within minutes to a few hours. Funding typically occurs within 24 hours of approval.

Q: What credit score do I need for a paperless loan? A: Many paperless loan providers accept applicants with poor or no credit history, focusing instead on income and employment verification.

Q: Are loans without paperwork safe? A: When obtained from licensed, reputable lenders, these loans are legal and regulated. Always verify the lender’s credentials and state licensing.

Q: How much can I borrow with a loan without paperwork? A: Loan amounts typically range from $100 to $1,500 for payday loans, though some lenders offer higher amounts based on income verification.

Q: Can I get multiple loans without paperwork simultaneously? A: Most states and lenders restrict borrowers from having multiple outstanding payday loans simultaneously.

Conclusion

A loan without paperwork can provide crucial financial relief during emergencies, offering speed and convenience when traditional lending falls short. However, these loans require careful consideration of costs, terms, and repayment obligations. By understanding the application process, eligibility requirements, and associated risks, you can make informed decisions that support your financial wellbeing.

Remember that while paperless loans offer immediate solutions, they should be used responsibly and only for genuine emergencies. Always explore all available options and choose reputable lenders who prioritize transparency and consumer protection.

Disclaimer: Nexus Loan Hub is a free loan matching service that connects borrowers with participating lenders. We are not a lender and do not make credit decisions. Rates, terms, and availability vary by lender and creditworthiness. Not all applicants will qualify for a loan or advertised rates and terms. Loans are subject to credit approval and verification. Funding times may vary depending on verification requirements and lender policies. Available in most states – some restrictions may apply based on state regulations.